Bluefin tuna: what is the impact of UK quota distribution?

To inform policy decisions on quota allocation, our study with RPA for Defra identifies the economic value of bluefin tuna for commercial and recreational fishers

Eastern Atlantic bluefin tuna have returned to UK waters after their population declined in the 1960s. Stock assessments undertaken since 2012 show positive trends in abundance, and in 2021, the International Union for Conservation of Nature (IUCN) moved bluefin tuna from ‘endangered’ to ‘least concern’ on its Red List of Threatened Species. Despite this improvement in bluefin tuna abundance, careful management is required.

Since the 2021 Trade and Cooperation Agreement between the UK and EU, the UK now receives an allocation of bluefin tuna quota. The International Commission for the Conservation of Atlantic Tunas (ICCAT) is responsible for the management and conservation of bluefin tuna in the Atlantic Ocean, and the Marine Management Organisation (MMO) is responsible for implementing fisheries management decisions in the UK, including on the sustainable management of fish stocks. For the period 2023 to 2025, ICCAT has allocated an annual Bluefin tuna quota of 63 tonnes to the UK, which is split between the commercial fishery, the recreational fishery, and a bycatch quota for certain gear types.

To inform policy decisions on quota distribution, the Department for Environment, Food & Rural Affairs (Defra) sought to understand how the costs and benefits of bluefin tuna fishing are distributed across different fisheries (commercial and recreational) and scales (individual, local, town, etc.).

In 2023, Defra commissioned ABPmer and Risk & Policy Analysts (RPA) to evaluate and compare the socio-economic value of the bluefin tuna fishery in English and Scottish waters, based on two trial fisheries.

The trial has been evaluated again in 2024 – 2025, to help inform decisions on how bluefin tuna quota is managed in the future. This updated evaluation considers the expanded bluefin tuna recreational fishery for 2024, and the changes in commercial quota allocation since 2023.

This latest evaluation focusses on two trial fisheries:

- The commercial fishery, which accessed the tuna through 13 trial licences

- The catch-and-release recreational fishery (CRRF), involving 90 charter and private vessels

ABPmer led on the commercial fisheries evaluation, while ICF led the evaluation of the recreational fishery.

Commercial fishery evaluation

Study approach

The commercial fishery evaluation used secondary data from the Marine Management Organisation (MMO), supplemented by face-to-face engagement with fishers and downstream operators. Three critical success factors were established to determine the scope of evaluation:

- Optimising quota use in both fisheries

- The social and economic benefits of the trial to coastal communities

- Develop best-practice guidance to inform future commercial trials applications

A benefits framework and socio-economic indicators were updated from the 2023 evaluation to provide comparable data for both years.

The UK had 66.15 tonnes of bluefin tuna quota for 2024. The MMO distributed 39 tonnes of the quota for use in a trial commercial fishery. Licences were distributed to 13 commercial fishing vessels to fish and land up to three tones of tuna each, using rod and reel gear. Five licence holders had previously participated in the 2023 fishery, whilst eight were new participants.

Findings

The total direct economic impact of the commercial bluefin tuna fishery in 2024 was £392,007, with a potential impact of £470,500 if all 39 tonnes of quota had been landed.

The economic impact (direct and indirect) of the fishery in 2024 was £713,000, with a potential economic impact of £856,000 if all 39 tonnes of quota had been landed. This equates to a Gross Value Added (GVA) from direct and indirect activity of £474,000 (with a potential GVA of £569,500).

When also considering downstream impacts (for example, processors), there was an estimated total GVA associated with the BFT fishery of £816,000 (with a potential GVA of £979,500) in 2024.

Conclusions

The 2024 commercial bluefin tuna trial fishery has generated a range of economic and social benefits, which have the potential to be expanded over time and with more commitment to the future of the fishery. Investments in new boats, processing facilities and relationships with international markets could all contribute to increasing the wider economic and social values of this fishery.

Recreational fishery evaluation

Study approach

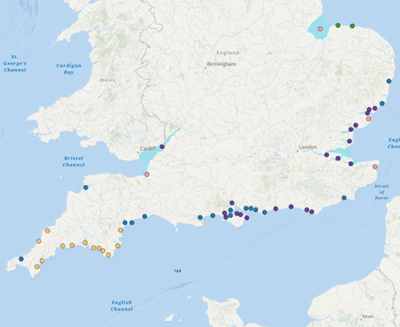

The recreational fishery evaluation, led by RPA, evaluated a catch-and-release recreational fishery (CRRF), in which bluefin tuna are caught, tagged and release to monitor their population, opened to over 90 charter and private vessels.

The 2024 report builds on previous evaluations during a CatcH and Release Tag (CHART) programme, in which between 15 and 25 charter vessels took part between 2021 and 2023. The methodologies used in the CRRF evaluation are consistent with those of the CHART programme, ensuring comparability and reliability of the results.

The evaluation assesses the fishery against three critical success factors:

- Optimising quota use

- Delivering social and economic benefits to coastal communities

- Ensuring the effectiveness of regulatory and voluntary measures in protecting fish welfare and minimising bluefin tuna mortality rates.

Findings

Overall, the 2024 fishery had fewer trips yet more captures per trip, and a lower mortality rate than expected.

Collectively, charter skippers who participated in the 2024 CRRF reported a total revenue of £715,000 and total operating profits of £331,000 from bluefin tuna trips. As a result of the 2024 CRRF charter, skipper operating profits were 109% higher compared to an alternative scenario where charter skippers offered regular sea angling trips. These profits demonstrate the significant additional value that the CRRF brings to charter skippers.

Various scenarios for future profitability of charter skippers were explored which accounted for bluefin tuna-specific investment costs. These scenarios highlight that due to high investment costs, high ongoing operating profits are important for long-term financial viability.

The overall expenditure of anglers participating in the CRRF was £2.6m. When accounting for imports and taxes and calculating the flow through the UK economy, the direct impact of this expenditure was £1.5m, a Gross Value Added (GVA) of £750k and a total economic impact of £2.9m.

Conclusions

The 2024 CRRF provided significant economic benefits to coastal communities, as well as social impacts including community events, improved relationships between skippers, and wellbeing benefits associated with bluefin tuna fishing.

Read the Commercial Trial Fishery report

Read the Recreational Fishery report

ABPmer supports policy-makers, regulators and the fisheries and aquaculture industry on marine environmental policy matters, assessment and management, including interactions between fisheries, marine protected areas (MPAs) and other marine developments.

Ready to discuss your requirements? Get in touch.

Header photo: BlueRushDepth/Shutterstock.com

Offshore wind in Scotland: updated marine plan at consultation

Scottish Government appointed ABPmer to support the revision of its Sectoral Marine Plan for Offshore Wind Energy, now at consultation

Read article

Fisheries management: best practice for applying the ecosystem approach

Our report for Defra provides recommendations for transitioning to an Ecosystem Approach to Fisheries Management (EAFM)

Read article

Updating the Estuary Guide: new data and interactive mapping

The Estuary Guide provides a free, extensive source of information about the UK’s estuaries; the Environment Agency has recently funded significant new updates, with more to come

Read article